Mastering Gardening Tips

Your essential guide to gardening mastery.

Comparing Insurance: A Costly Mistake to Avoid

Avoid costly insurance mistakes! Discover how to compare policies the smart way and save big on your premiums. Don’t miss out!

Top 5 Common Mistakes When Comparing Insurance Quotes

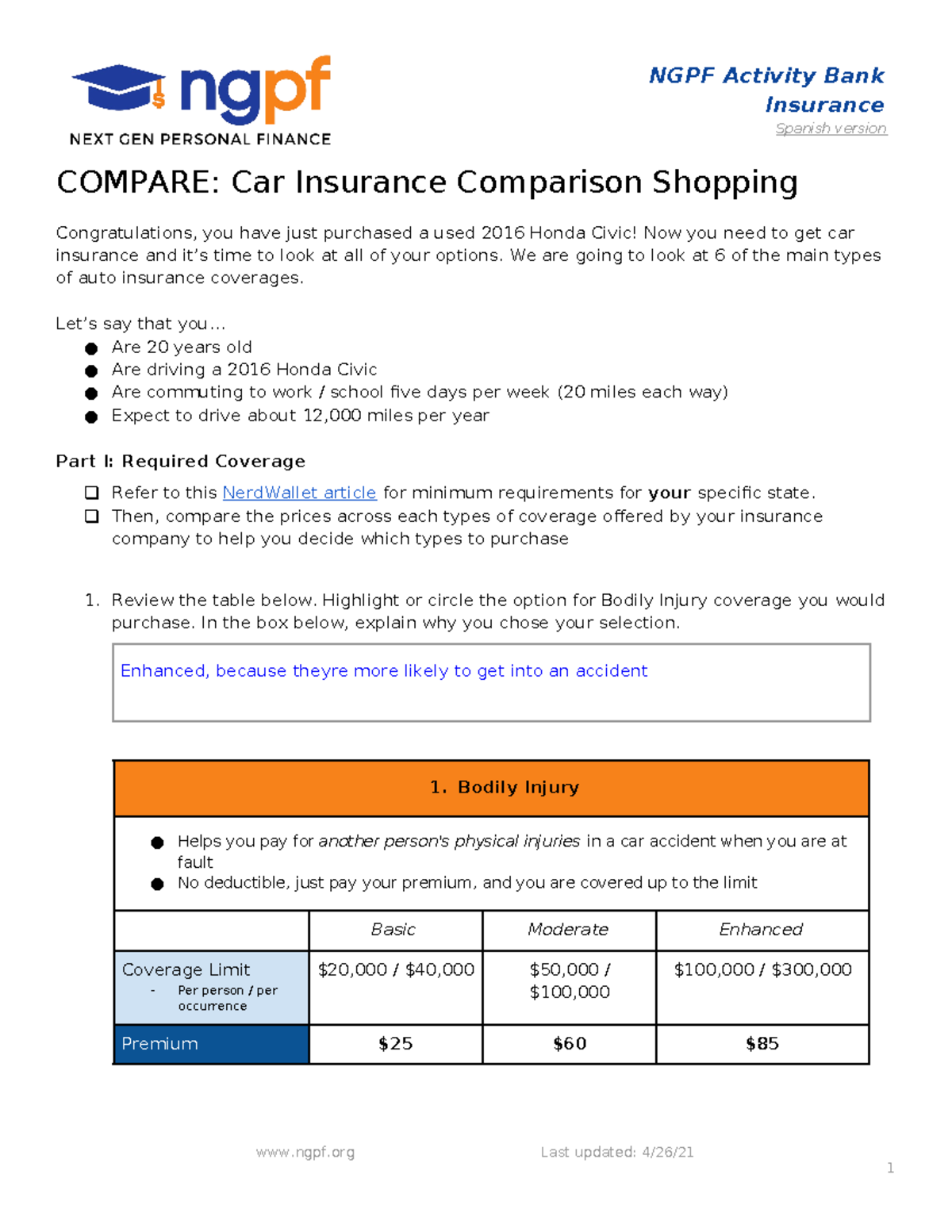

When it comes to shopping for insurance, many individuals fall into the trap of overlooking critical details. One of the common mistakes is simply comparing the premium prices without understanding what each policy covers. A low premium might seem enticing, but if the policy lacks essential coverage, you could end up paying much more in the long run due to out-of-pocket expenses. Therefore, it’s crucial to not only look at the quotes but also at the coverage limits, deductibles, and exclusions.

Another frequent error is failing to assess the deductibles associated with the quotes. Some policies may have lower premiums but higher deductibles, which can lead to unexpected costs if you need to file a claim. Ensure you compare both the premium and the deductible side by side to understand the true cost of each policy. Additionally, many consumers neglect to take advantage of discounts offered by insurers; be sure to ask about any applicable discounts that could lower your rates.

What You Need to Know Before Comparing Insurance Policies

When comparing insurance policies, it's essential to identify your specific needs and requirements. Consider factors such as your budget, the type of coverage you need, and any specific risks you may face. For example, if you're looking for health insurance, think about whether you need comprehensive coverage or just basic plans. Additionally, create a checklist of criteria that are most important to you, such as premiums, deductibles, and coverage limits.

Another crucial step before making comparisons is to understand the various terminology used in insurance policies. Terms like deductibles, co-pays, and out-of-pocket maximums can significantly affect your choice. It’s advisable to take the time to read through the policy details carefully and even consult with insurance professionals if needed. This way, you will ensure you're making an informed decision that aligns with your financial and personal needs.

Are You Making These Costly Insurance Comparison Errors?

When it comes to finding the best insurance coverage, making costly insurance comparison errors can severely impact your financial well-being. One common mistake is focusing solely on the price of premiums without considering the coverage limits and deductibles. It's crucial to understand that the cheapest option may not provide adequate protection in case of an emergency. Always compare the value of the policies, which includes understanding what is covered and what exclusions exist. Additionally, ensure you're comparing similar policies; for example, don’t mix comprehensive coverage with basic plans just because they have similar premiums.

Another frequent error is neglecting to read the policy fine print. Many consumers overlook important details that can have significant implications later on. For instance, some policies might have hidden fees, clauses that limit payouts, or requirements that seem minor but could affect you during a claim process. To avoid these pitfalls, create a checklist of essential features to compare among different policies, such as customer reviews, the insurance company’s reputation, and claims handling process. By addressing these factors, you can make a more informed decision and steer clear of those costly insurance comparison errors.