Mastering Gardening Tips

Your essential guide to gardening mastery.

Stock Market Shenanigans: Why Your Next Investment Might Just Be a Gamble

Uncover the shocking truths of the stock market! Is your next investment a smart move or just a gamble? Find out now!

Understanding Market Volatility: Is Your Investment a Smart Move or a Risky Gamble?

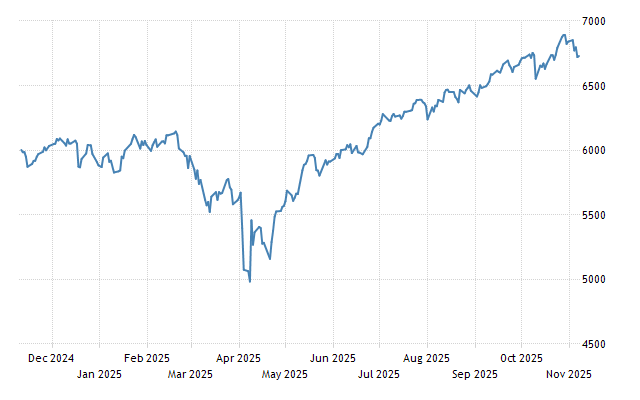

Understanding market volatility is essential for making informed investment decisions. Market volatility refers to the fluctuations in the price of financial assets and can suggest the level of risk and potential reward associated with those assets. When investing, it's crucial to ask yourself: Is your investment a smart move or a risky gamble? Periods of high volatility can present opportunities for savvy investors, but they can also lead to significant losses if not approached with caution. For more insights on market volatility, you can visit Investopedia.

To evaluate whether your investment is prudent in the face of market volatility, consider factors like market trends, economic indicators, and your own risk tolerance. It's also beneficial to diversify your portfolio to mitigate potential losses and enhance your chances of achieving a good return. As you navigate through turbulent markets, remember that volatility is a normal part of investing; understanding how to leverage it can transform a risky gamble into a calculated strategy. For strategies on managing volatility, check out Forbes.

The Psychology of Investing: How Emotion Leads to Stock Market Shenanigans

The world of investing is often portrayed as a realm governed by logic and rationality. However, the reality is that emotion plays a significant role in the decision-making processes of investors. Behavioral finance studies reveal that psychological biases, such as overconfidence and confirmation bias, can cloud judgment and lead to poor investment choices. For instance, during market booms, investors may become overly enthusiastic, driving stock prices to unsustainable levels. Conversely, in times of market downturn, fear can trigger panic selling, resulting in significant losses. Understanding these psychological triggers is essential for developing a more disciplined approach to investing.

Moreover, the influence of emotion on investing is evident in the phenomenon of market sentiment, which reflects the overall attitude of investors towards a particular market or asset. This sentiment can lead to shenanigans such as herding behavior, where investors collectively follow trends without conducting proper research. According to a study published in the ResearchGate, fluctuations in sentiment can significantly affect market volatility. By recognizing the power of emotion in investing, individuals can better navigate the complexities of the stock market and make more informed decisions.

Are You Playing the Game or Making an Investment? Debunking Common Stock Market Myths

When it comes to investing in the stock market, many people often confuse playing the game with making an investment. It's crucial to understand that the stock market is not a casino, where success relies solely on luck or timing. Instead, a well-researched investment strategy based on thorough analysis and understanding of market trends can significantly increase your chances of achieving long-term financial goals. According to a study by Morningstar, consistent investing strategies rooted in research outperform speculative trading.

Moreover, many myths perpetuate this gambling mentality in stock market participation. One common myth is that you need to be rich to invest in stocks. This misconception can deter many potential investors from entering the market. In reality, even small investments can grow over time with the power of compounding. Platforms like robo-advisors enable individuals to start investing with minimal amounts, making it accessible to all. It’s essential to debunk these myths to foster a healthier and more informed approach to investing.